- Home

- Money

Things To Do On A Long Weekend Without Spending A Lot Of Money

Having long weekends is great if you have something planned in advance. Otherwise, it could be very boring. You might rather just get back to work. While you can’t stop the long weekend from happening, you can at least do things that will make you feel fulfilled. You can check online for things to do near me or you can also do activities at home.

Host a game night

Game nights are always fun. You can just invite your friends to come over, prepare something to eat and just have fun. Your friends can also bring a dish for everyone to share. Charades and card games are among the most common options.

Visit a local museum

You may find that you have a museum in your local neighbourhood, one that is easily accessible or one you have yet to visit. Museums can be very educational, children can learn lots of new things and experience many different activities. You maybe surprised to see just what’s going on in your neighbourhood. If not movies, you could try reading all those books you’ve been meaning to read but just never got round to it. Some of them can be educational too. Your kids will love to see those places and learn new things. You might be surprised by what other local attractions there are.

Do a movie marathon

How many movies have you missed because you were too busy with work? This is your chance to finally catch up. You can list down all the movies you have yet to watch and spend the entire long weekend watching them. Take the time to go out just to buy some snacks, and just watch the movies. You might also ask your friends to come over. If not movies, you can try reading books that you are yet to read.

Have fun outdoors

There are a lot of exciting outdoor activities that you and your friends can do. During a snowy month, you can go for a snowball fight. You can also just go out to breathe fresh air. You may also want to go sledding. A day at the park where you can just eat and spend quality time with your family can also be very relaxing. Regardless of the activity, it will be fun if you are with the people you love.

Bake with friends

Baking is always a relaxing activity. You just have to mix stuff up and eventually, you come up with something really amazing. Baked goods smell good and taste great. You might have also find some recipes online and you want to finally give it a shot.

Just sleep

While you are working, you might complain about not having the time to just take a nap. This is your chance to do so. You know that you are not working the next day, so you just have to turn the alarm off and have a good night’s sleep. This opportunity does not come often, so you don’t want to waste it.

There are a lot of activities that you can do over a long weekend. You don’t have to feel like you want to lock yourself up at home and do nothing. Choose whatever makes you feel satisfied or something that you have not done for a while.

Forklift Equipment Leasing: The Not-So-Obvious Advantages

We’re getting to the stage where most of us know that the benefits of equipment leasing far outweigh anything that you can get from just purchasing machinery outright. This has now been commonplace for a number of years, and it takes a very good reason for companies to opt to purchase anything outright based on the back of this.

When we talk about the advantages, most people are aware of the obvious financial ones. For example, if you are looking into forklift equipment leasing, it quickly becomes apparent that you don’t have to invest tens of thousands of dollars in one go. Instead, this is split out over a number of years, which also represents your balance sheet very nicely.

If we delve deeper into the subject, there are other reasons why companies are following this approach though. Through the remainder of this article, we will now take a look at some of these benefits in further detail.

The I-factor (inflation)

Inflation is spoken about a lot in the general sense of the word, but when it comes to purchasing equipment it’s rarely mentioned. This is surprising when you start to analyze the obvious benefits that are open to businesses.

Most equipment leases are arranged for years at a time. Ultimately, over the course of these few years, inflation is going to grow and make the equipment more expensive. The savvy businesses who are tapping into the principal of leasing realize this, and tend to lock in fixed rates. This means their purchases aren’t affected by inflation – and they effectively pay lower than market rate later down the line.

Bundle everything together

When we talk about bundling, we’re referring to everything else that revolves around the equipment you have hired. This might be the cost of installing such equipment, as well as the regular maintenance that might be required to keep it going. As anyone who has dealt in equipment will state, these costs can quickly add up and actually come to as much as the equipment itself in some cases.

When you bundle, you can negotiate to have everything pieced together in the same package. This is an approach commonly used in retail, and the same benefits are on offer here. In other words, you get a lower price for purchasing everything together, rather than buying the equipment, installation and maintenance separately.

The value of asset management

Following on from the above, we can now talk about the benefits of asset management. Again, this is all about seeing the bigger picture when it comes to your equipment, rather than just looking at the equipment on its own.

Asset management refers to the whole process behind your new equipment. It needs to be sourced and delivered before eventually being disposed of. All of these issues take up your company’s resources, yet some leasing companies will handle this for you. You might find that the time savings provided to you far outweigh any costs that might be added onto the equipment for these services.

Mortgage Lenders in Florida and What to Consider Before Applying

Buying a house looks super exciting the face of it, and the truth is that there are many aspects of buying a property that can most definitely be exciting. From the moving process to deciding on paint colours, there is a lot to deal with. With this being said however, there are many aspects of this process which are frustrating and difficult and you must be prepared for it. One such difficulty can arise when the time comes to look for mortgage lenders in Florida alone there are many, many lenders, but getting the right one is not always easy.

Before you start looking out for a mortgage lender, and even before you start looking for the mortgage itself, there are many ting which you will need to consider, and here are some of the most important considerations to make.

Whites Your Credit Score

Nobody wants to face the embarrassment of being turned down for a mortgage, especially if you have already found a house that you wish to buy. One of the key reasons why a lender may turn down your application for a mortgage, is the health of your credit rating. Your credit rating, or credit score, is a universal measure which essentially tells financial institutions how trustworthy you are in terms of lending money. A bad credit rating can appear if you have had issues with debt in the past or unpaid loans, it can however, also be as a result of never having had credit before. Make sure that you know what your credit score is, before you apply for a mortgage, to save yourself any disappointment.

What Can You Afford?

When it comes to budgeting how much money you can afford each month to pay for your mortgage, it is really important that you are completely honest with yourself. Very often people will take on large mortgages just because they are offered them, without much thought for their monthly bills, and how they will be able to afford the repayments long term. It is said that 60% of your salary should be put towards rent or a mortgage, and the monthly bills, any higher than this and you will run the risk of giving yourself headaches when it comes to repaying your mortgage. Make sure that you are brightly honest about what you can afford to pay.

Understanding the Mortgage

The final consideration which you need to make is whether or not you understand the different mortgages. There are many mortgage products which banks and lenders use, each with their own benefits and disadvantages. In order to avoid being hoodwinked or sign up for a mortgage which you don’t understand, it is very important that you spend the time on learning about the different mortgages, and work out which one best suits you. Some mortgages are fixed for a term, others are based on market value and others require the interest to be paid first, do your research and make sure that you know what you are singing up for.

The Worst Lottery Winner Horror Stories

For most people, winning the lottery is a dream come true. Overnight, all of your worries have seemingly been erased and a whole world of opportunity has opened up to you. From fast cars to luxury holidays and dream houses, you now have the money to do it all. While this is very true in the majority of cases, unfortunately for some it does not turn out like that.

In rare cases, the dream of a lottery win can soon descend into a real-life nightmare. From grasping friends, greedy family, and strangers all desperate to access your new-found wealth to more self-inflicted issues, navigating the minefield of a lottery win can be too much for some.

Here, we take a look at some of the worst lottery winner horror stories in history.

Marie Holmes

Before winning the lottery, Marie Holmes was a normal person who worked a standard job at her local Walmart. Her life changed for the worse overnight when she discovered her random numbers in the lottery had netted her $188 million! The fortune soon dwindled due to poor financial investments and the multiple lawsuits that she had to fight. Added on to this was the fact that her boyfriend had to be bailed out of jail numerous times, which ate into her money. By the end, she was emotionally and financially drained.

Curtis Sharp

Back in 1982, Curtis Sharp won big on the lottery. Scooping $5 million, which was a huge sum back then, he soon set about spending his wealth. Sharp certainly enjoyed himself and was thought to have spent $1 million each year after the win to see it all gone within five years. Much went on cars, women, houses, and gifts to family, and what started as a massive amount soon trickled away. Now a minister in Tennessee, his advice to future lottery winners is to think carefully before starting to spend. His story is certainly a cautionary one of the trouble and dangers inherent in many lottery winner horror stories.

Billie Bob Harrell Jr

Another resident of the US who thought his prayers had been answered was Billie Bob Harrell Jr, who scooped an insane $30 million in 1997. After quitting his job at the Home Depot, he planned to retire from work and live the high life. Not wasting any time, he took his family on a Hawaiian vacation before buying houses and cars.

Unfortunately, this was about as good as it got for him. Beginning to get lots of unwanted attention from strangers after his money, he also made a poor financial investment that saw him lose a lot of his fortune before his wife left him.

Tonda Lynn Dickerson

When Tonda Lynn Dickerson found out that she had won $10 million on the lottery, she was working as a Waffle House waitress. What makes this story interesting is that all the other Waffle House waitresses also thought that their luck was in due to a verbal agreement between them. The waitresses claimed that they had agreed to split the winnings between everyone. Tonda didn’t remember this agreement, however, and kept all the money for herself!

The other waitresses were furious and sued her for the money that they thought she owed them. Though she won all the cases against her, the stress left her worn out. Figuring that she needed to find a way to protect her assets going forward, she created a corporation to this effect. The only problem came when she gave a gift in shares through the corporation – the IRS hammered her for around $1 million in taxes!

Abraham Shakespeare

Winning $30 million in 2006, Abraham Shakespeare has a tale as tragic as a play from the Bard of the same surname. A decent chap by all accounts, he suffered from people leeching off his winnings and stealing away his cash. He also gave away a lot of his fortune to people who needed it most, which saw it dwindle quickly. However, his real undoing was getting mixed up with Dorice “Dee Dee” Moore.

Moore approached him on the pretense of being interested in helping him write a book on the dangers that lottery winners face. Agreeing to the proposal, she gradually took over all his property and money as his de facto financial advisor. After a heated argument one time, Moore shot and killed Shakespeare.

Lottery victory is still a dream for many

Of course, the above tales are rare, and for many lottery winners it really is a dream come true. As long as you are prepared for what follows and how to handle it, then you should be fine. Be careful about who you trust, who you tell about your win, and your level of spending. With a sensible approach, you should live a happy life with your new fortune and avoid becoming one of the horror stories in the news.

Tips For Saving Money When Buying Diamond Jewelry

There is no question that diamonds are great looking jewelry. They sparkle. They look elegant. They can go well with any formal occasion like weddings and other events. The only downside is the price. Considering that they are really durable and they look amazing, diamonds are pegged at a really high price.

This could be a tough decision if you want to give one to your special someone but you are on a tight budget. Here are some ways to reduce the cost when you check out diamond jewelry as a gift.

Carat and size are not the same

Just because you are giving a 1.00-carat diamond, it does not mean that it is bigger than a 0.90-carat diamond. Carat is related to weight and not the size. Your partner might not be particular about the carat, but the size. A bigger piece of diamond jewelry could be better if the receiver wants to at least brag about having received one.

Compare options

If you think one store offers quality diamonds but at a really high price, you might want to look at other choices and compare. The same jewelry might be there or at least one of similar design, but the price is lower. You also need to understand the price per carat and decide whether it is really worth going for a higher carat when the price difference is too high.

Check out clarity

You need to check the grade of clarity first because, sometimes, a piece of jewelry looks better if you consider clarity, but it has a lower price tag. It depends on how it looks in the end. Therefore, you should not automatically conclude that more expensive pieces of jewelry are better.

It doesn’t have to be round

When it comes to diamonds, a round, brilliant cut is highly preferred. It is the most expensive so people think that it is the best cut. However, it is not necessarily the most visually appealing. It depends on the person wearing it. Therefore, you don’t have to stick with round cut if you think there are better designs out there. A cheaper princess cut that looks better aesthetically could be your choice. You must also consider what you personally like or the preference of the person receiving it.

Don’t force yourself

After looking for ways to save money, you might still think that diamonds are expensive. If so, don’t force yourself to buy one. There could be other milestones in life where diamond jewelry could be given. You might also be more financially stable at that time. However, if you think that you can afford one now, look at the choices at Patrick Saada and have a blast choosing.

5 Reasons Why Playing Strategy Games Online Is Better Than Playing IRL

Source: Pexels

Throughout human history, games have been played face-to-face. Tension, the joys of winning and the crushing melancholy of defeat were all experienced people in the same vicinity, and there was no escaping it. If you wanted to play, you literally had to have your game face on.

In no other gaming genre was this more true than in strategy games. Instead of basing moves and the ultimate result on luck or a roll of the dice, strategy games are determined by each individual players’ choices and skill. To win, you must come to the table equipped with tactics, a solid knowledge of the game you’re about to play and the patience to see each session through until the end.

Some of the world’s oldest games are strategy based, whether they be board-based like chess or card games like poker. So, it was no surprise that when the internet came along they transitioned almost seamlessly into the online space. Now, you can play chess with people around the world, battle others on video games, while poker rooms and online casinos continue to thrive. But is playing strategy games online better than playing than in real life? We think so, and here’s why.

Poker Face Anywhere: Ultimate Accessibility

Source: Pexels – To access millions of online games, all you need is an internet connection.

Out there in the real world, organizing a strategy game is quite the Endeavour. First of all, you have to find a game, then a place to play and of course people to play with. In the online world there’s no need to do that, as everything you could ever need is just a Google search away. No matter what genre of strategy game you fancy playing, chances are you can find it on your PC, tablet, console or even your smartphone. Fancy playing an MMORPG? Settle down for the evening with March of Empires or get on Overwatch. How about trying your hand at Texas Hold’Em or blackjack? There are literally thousands of games going on right now that you can join.

Then, once you’re ready to play you can join others who are already online around the world or invite friends to come play with you. Really, one of the best things that the internet has brought us is the ability to connect with anyone, anytime – and this is a great benefit for anyone who loves strategy games.

A Vast Variety of Games

In addition to being more accessible than live games, online games are incredibly varied and diverse. While specific brands may not be available on every platform, chances are you can find some variation of your favorite board or video game on the internet or as an app. You never know you may even find something you prefer.

Even games that really don’t require a lot of equipment and can more easily be played in real life have evolved in the online world. Take card games such as poker for example. While you may only need a pack of cards and some chips to get started with your own live game, chances are you still won’t get the variety available online due to the skills, experience or knowledge limits from your fellow players. Meanwhile, at gaming operators like 888poker there’s Texas Hold’em, Omaha hi/lo, 7 Card Stud, SNAP and even live streamed webcam poker games that you can play at any time with players that have mutual skills.

No Physical Tells Or Psych-Outs

Source: Pexels – By playing through a screen, the ability to call your bluff is removed entirely.

During real-life gameplay, it is incredibly easy to tell whether your competitors are doing well for themselves or when they are heading down a slippery slope. This, of course, is also true for you and chances are you’ve been sending signals giving away your game throughout most of your live gaming sessions. It’s human, it’s just something we all do, but it can really affect the outcome of the game entirely.

Fortunately for online players, this isn’t a problem, unless of course you shout about how your game is going over the microphone. This is why games that require some secrecy and discreetness like turn-based games are best online – there’s no way for opponents to garner information from your physical tells or psych you out because they can’t see you. Now, you may think that this also removes the conversational aspect that is crucial to games such as first-person shooters and even poker variants like Texas Hold’em, but most developers have already set chat boxes and other conversation tools in place to fill this gap. That means that you get to socialize without compromising your game.

No More Wagering Woes In Games Like Poker

When it comes to games where money is involved such as blackjack, poker or maybe really intense sessions of Settlers of Catan, playing online is a huge advantage for you and for your wallet. When playing live, there’s often a real sense of false bravado and competition involved – that is, if someone starts raising the stakes a little, you may feel obligated to the same. After all, if you don’t then you’ll probably be kicked out of the game entirely.

However, online money games often have preset wager amounts. This is most noticeable in online casino games, where players can usually open for 2x, 2.5x or 3x the big blind, a modest amount considering that ensures the high rollers can’t push other players to bet more than they can afford. Combine that with the inability for others to psych you out or make you feel less than if you decide to bow out and you’ll find yourself having a much more enjoyable game.

The Pacing Is Far Faster

Much like the online wagering system allows players to have more reasonable monetary controls, online games also promote more reasonable pacing. However, whether this is a benefit of online games depends on the specific game as well as you as an individual. If you enjoy fast play then you will no doubt enjoy many of the MMO and online FPS titles out there, as players have to be on their toes to keep up. The same is true of iGaming releases, especially card games such as baccarat and poker where players have a set amount of time to deal with their turns. In the case of poker, specifically, certain operators have focused on bringing fast-fold variants such as SNAP to their sites, to allow for ever greater speed.

Live games, on the other hand, are probably preferable for anyone who enjoys a slower pace and doesn’t find waiting around for others tedious. If you need more time to think and experience the game, you can stick with real-life games, otherwise it’s time to get online for the real fast-paced stuff.

There’s no doubting the appeal of strategy games, whether they’re online or offline. They offer incredible social, interactive and engaging experiences for players of all kinds, allowing players to find entertainment while also being thought-provoking. For anyone who plays strategy games often, there’s no doubt that they will find themselves applying skills they have developed in-game to their lives overall.

Still, we stand by the idea that live games have less to offer than online experiences when compared. As we’ve found, online strategy games are far more accessible and there’s more variety, plus limitations are removed such as physical tells, wagering woes and pacing issues.

Do you prefer playing online or playing strategy games in real life? Do you dabble in a bit of both? Let us know in the comments below.

How To Find The Right Credit Repair Company

Credit scores tell a lot about your financial future. Keeping a good credit rating means that it will be easier for you to apply for loans and there are less charges when billings are sent to you. On the flip side, having a bad credit score will get you scrutinized by lending companies and financial institutions if you really can pay their dues.

For instance, you want to invest in a sophisticated condominium unit. Most of the time, clients avail of bank loans in order to initially help them pay for the fees. However, these banks will charge them later on. One of the things that property sellers look at is your credit report. This contains your credit score taken from your transaction history, amount you owe, and credit history among others.

What if you have a bad credit score? Is there a better way out?

Moments When You Need To Hire Credit Repair Companies

In the market today are credit repair companies that are present to assist people in troubleshooting their credit scores and making the necessary action from that point on. They work to coordinate with credit bureaus to avoid making the mistakes on your billing that may affect the scores. Here are some indications that you need to hire credit repair companies.

- When you experience financial hurdles especially on loans. Credit scores and loans are very much related to one another. It is important to select the right credit repair company that will attend to your financial woes.

- Hiring one needs some investments on your side, which means that you will have to pay them for their services. It is not advisable to spend and waste your money on a company that does not perform well considering that you have been currently stressed out of this bad credit issue.

- When you want to free yourself from the stress and responsibility of doing it on your own. It is always possible to fix your credit scores on your own. However, this takes a lot of patience and time on your end.

You have to look for informative resources online like credit monitoring services that https://crediful.com offers, not to mention understanding some of the technical terms. Hiring a credit repair company will ease you out of this burden since they can take charge of handing your concerns.

Ways To Find The Right Company

The best credit repair company entails some considerations and factors to think about on your end. Generally, they write “Letters of Deletion” sent out to credit bureaus in order to remove mistakes on the credit reports and billing. Here are some of the things to consider when hiring credit repair companies.

- Find licensed professionals

When searching around for these services, make sure that the company you are eyeing has experienced staff members that have been in the business for several years. There have been several issues filed with them and they have handled these right, while learning from their past mistakes.

- There are instances when the best providers will also offer credit counseling and strategies on how you can build your credit scores.

- Avoid businesses that charge fees without actually rendering their services right.

- Be aware of unnecessary guarantees

It is common for several service providers to describe their offerings as “100 percent guaranteed” along with the promise of giving the best results and fixing your financial problems. However, do not fall prey into these and it still pays off to personally coordinate with them before the actual hiring process.

- One of the best indications of a good credit repair company is the group that discloses your legal rights with you at the beginning of the deal. If you notice that they miss out on this stage, then it is time to take your next choice.

- Asking for money from you and sending these directly to them instead of bringing this payment to your creditors is considered a violation of statewide regulations.

- Differentiate credit repair services and credit repair scams

Because of the increasing need of the market to raise or improve their credit scores, a lot of companies claiming to help you across the process is springing up. Nowadays, there are groups that seem to offer credit repair but are actually scams.

- According to the law, credit repair organizations are only allowed to charge for their services after the duration in which they have been rendered. An upfront fee is indicative of a less reputable company.

- Some companies may tell you to repair credits through file segregation or creating a new credit identification. Any business that requires you to do so is considered a scam.

- Look at Better Business Bureau reports

Finding a good credit repair company is not a service rendered on a silver platter, since it also involves doing your own part. Before signing a deal with an organization, take the necessary – and helpful – step to check reports from BBB. This bureau records any complaints made against a company. This will continuously distinguish fraudulent businesses and will help you tick off those companies from your list, and only land on the most suitable ones.

Conclusion

Credit repair is an essential part of making sure you maintain a high credit score, or if you want to work your way to one. Credit repair companies can be of great help in assessing the kind of strategies you could do to make proper adjustments to increase your finances, but you always have to consider the above before choosing the company you think is for you.

Ron Blum Looks at the History of Government Spending and U.S. Economics

In 1992 Rob Blum made an appearance at the Senate Committee due to his expertise as an economist. His knowledge and experience on how government spending works was particularly appreciated and, in fact, the focus of his entire experience. Today, he hopes to shed some more light on how government spending works, and where it comes from.

Ron Blum on Three Types of Government Spending

According to Ronald Blum, there are three key types of government spending:

- Final consumption expenditure, which means the government buys services and goods that are consumed by the community.

- Gross Capital Formation (GCF), which means the government buys services and goods that could benefit the community, such as infrastructure and research.

- Intermediate consumption expenditure, which are all other services and goods the government buys, generally through an intermediary.

As an economist, Ron Blum knows that the government also makes transfer payments. These are money transactions in which no goods or services are purchased. Things like social security and surplus are included in this. Meanwhile, the money itself comes from seignior age, government borrowing, and tax payments.

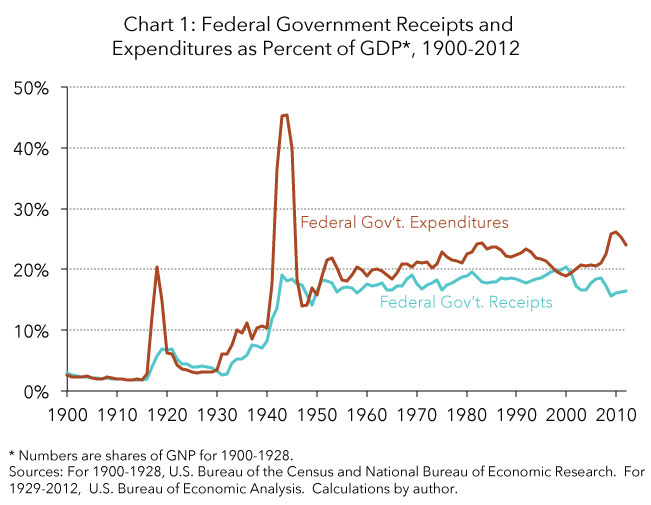

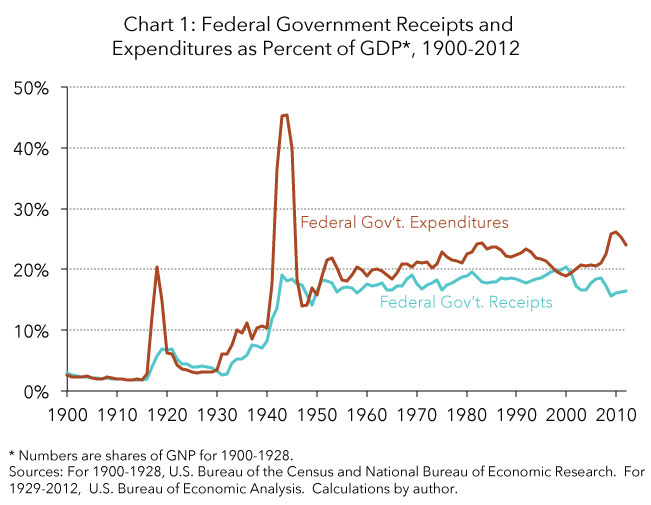

Ronald Blum also wants to point out the GDP – the Gross Domestic Product. This is the gross capital formation and final consumption expenditures made by the government. Essentially, the GDP shows how much money a country has.

A History of Government Spending

One of the things Ron Blum raised during his appearance at the 1992 Senate Committee was explain where government spending comes from. He pointed out economist John Maynard Keynes, who developed the theory that when the government spends more, demand for aggregate funds will grow, and consumption will grow as well. When that happens, production goes up, too. Indeed, under that theory, the Great Depression ended because the government starting spending, specifically on World War II. If a country is experiencing an economic downturn, the country has to start spending to fix it.

In the USA, the United States Census Bureau publishes all the expenditures of the government. The Statistical Abstract of the United States updates this each year. Of course, it is difficult to properly interpret these cash flow statements. Ronald Blum is arguing, therefore, for more accrual reporting, which provides a clearer picture overall.

Every five years, the Census Bureau updates their records, and the financial census is updated each year. What this shows is that, in 1902, the government’s expenditure stood at 7% of the GDP. Yet, in 2006, it stood at 35%. What this demonstrates, mainly, is that growth is still quite slow. Welfare spending often decreases, whereas military spending often increases. Indeed, war is said to be fantastic for the overall economy.

Understanding the economics of a country as large, varied, diverse, and complex as the United States is almost impossible to do. However, for Ron Blum, it has become a true passion. Himself and several others focus specifically on gaining a greater understanding of this country’s finances, and on determining whether or not Keynes was right.

Interesting Jobs In San Diego For People Who Like Something A Bit Different

Many jobs seem the same. Go to the office, clock in, get some work done in between talking to colleagues, checking social media, and then clock out and head home. There’s a sense of every day being the same with many of these types of jobs, which makes you want to count the hours until you can clock out.

There are plenty of interesting jobs in the San Diego area for people who like to try something a little bit different to the norm. The day passes much faster and they’re more enjoyable to do. Let’s look at a few now.

Model Makers

Making models either using plastic or some kind of metal is an exacting thing that often has to be completed to scale for architects, realtors, and other professionals who require them for demonstration purposes. The job is in demand and pays around $50,000 per year for people with good experience and real skill, rising to around $70,000 for really talented model makers.

HVAC Technician

An HVAC technician works installing heating, ventilation, and AC systems, mostly for business users but also some residential ones as well. In the job, they go outside to travel to the client’s premises or homes, meet the customer in person, and listen to what problem they’re experiencing with their system. Then they get to work diagnosing the exact issue and what parts will be needed (or adjustments) to get the system back up and running again. Whether they’re feeling the heat in the summer or chilly in the winter time, rescuing people with a fixed HVAC system feels personally rewarding.

To become an HVAC technician, you need a degree that’s focused on this trade. You can learn about what you need to apply for the right degree course from this best HVAC training site. They will show you the different schools that teach the course. Some will be nearby while other schools often offer online courses to make it easier to study in your own time.

Claims Investigator

For someone with an eye for detail who likes to dig deeper into issues to find out the real skinny, the role of a claims investigator is interesting one. As an investigator, you would get to investigate the validity of claims made by policyholders. Usually, only the questionable cases get referred to the investigator to examine whether the claim is inaccurate, either accidentally or on purpose. The role pays over $65,000 per year because of its importance to the insurance company.

Credit Counselor

A credit counselor works with people who are having problems managing their personal finances, and particularly with regards to their use of debt. The US education system sadly still doesn’t address how we as adults should manage our money and, as a result, money, and debt are often mismanaged due to lack of knowledge or understanding. A credit counselor can help to bridge that knowledge gap by educating the people s/he meets to help them turn their financial lives around in short order.

There are plenty of interesting jobs available, so you don’t have to work in one that you dislike. Not everyone realizes this. Many of us fall into a profession and never leave it because we don’t believe we can actually choose. But, we can! It is time to improve your happiness and change your profession if you’re not enjoying it any longer.

Budget Makeover? Here’s Where to go For Inspiration

When it comes to decorating, or redecorating your home, money is usually one of the single biggest driving factors behind what it is that you are looking to do. Personally speaking, I would always invest money in rooms such as the living room and the kitchen, but when it comes to spare rooms and little used bathrooms, I just can’t justify spending the big bucks. Equally, as much as I love to look online at some of the beautiful design ideas which the likes of Gary Friedman puts forward on his YouTube interviews, I much prefer to use the internet to get ideas for budget makeover tips. If you are looking to give your room or home a makeover, but you don’t want to spend a great deal of money, here is where you can go to find some inspiration for budget home style tips.

Not many people are aware that Facebook can be used for far more than simply chatting and connecting with friends. In fact, this is a community which has many mini-communities within it, by way of groups. With a quick search on Facebook, you can find a number of groups which have been set up by those wishing to share their budget home designs and hacks which can help you achieve the look that you want in your home, for a fraction of the price. If you are going to use these groups, make sure that you are active and that you engage with people, so as to add value to the community.

I used to always follow Pinterest just to look at the weird, wacky and utterly wonderful things which people all over the world do with their homes. When the time came to decorate my home on budget then, I decided that Pinterest was the best place to go to look, and I was absolutely right. If you haven’t used Pinterest before, it was originally set up so that people could create their very own ‘notice board of the internet’ which means sharing cool things and great ideas. With this in mind, if you are looking to get some budget design hacks, there is no better place to look than here on Pinterest.

I always knew that Reddit was a great place to go for strange online offerings, but what I hadn’t realized was that there were sub-Reddits, which are committed to saving money and budget home design tips, in fact there are quite a few. You will need to do some sifting through in order to find the right section for you, but once you do you can get some really great ideas. What I love about the items that are shared on Reddit is that you will see link accompanying the idea, for where you can buy the products, and where the original idea has come from. As happens online, you start looking at one thing, click a link or two and all of a sudden you find yourself in places that you never thought, this is exactly what happened when I was looking on Reddit, and I managed to get some amazing ideas for my home.